If you want to know how to travel on points, you’ve landed in the right place. This article will show you how to travel for free using credit card points responsibly.

Disclosure: This post may contain affiliate links, which means we’ll receive a commission if you purchase through our links, at no extra cost to you. Please read full disclosure for more information.

Imagine turning your everyday spending into your next dream vacation?

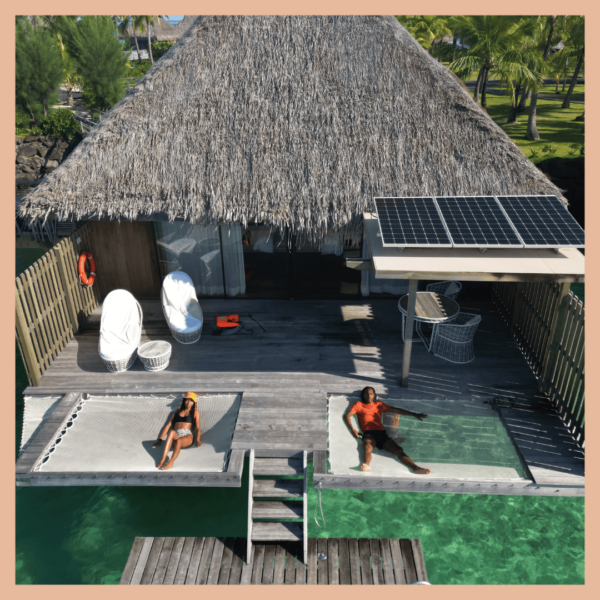

From bucket-list stays to first-class flights, the right strategy can help you travel in style without overspending.

For example, we recently flew Qatar Airways Business Class to the Seychelles via Doha.

Thanks to points, we enjoyed nearly 20 hours of unmatched comfort in lay flat seating, including access to the luxurious Doha business class lounges.

It was a trip that combined ease and elegance—all made possible by leveraging travel rewards.

Let’s break down how you can earn, redeem, and maximize travel points to achieve your travel dreams.

What Are Travel Credit Card Points?

Travel points are rewards you earn from your credit card for spending. These points can be redeemed for flights, hotels, rental cars, and other travel-related expenses.

Some cards even offer perks like lounge access, complimentary upgrades, or travel insurance.

For example, our Capital One Venture X card gives us primary rental car insurance.

By using the right travel credit card, you can turn your everyday spending into opportunities to explore the world.

The right card will be different for each person, depending on your typical spending habits and travel goals.

RELATED ARTICLE: What Credit Cards Are Good for Travel?

How to Earn Credit Card Points for Travel

The first step is picking the card that aligns with your travel goals. Whether you’re looking for flexibility, premium travel perks, or no annual fees, there’s a card for you.

Check out our article on the best starter travel cards to help you consider the perfect card to begin with.

Ways to Earn Points

- Sign-Up Bonuses: Many travel credit cards offer substantial bonuses when you meet a minimum spend requirement within the first few months.

- Everyday Spending: Earn points on all your purchases, with bonus categories like dining, travel, or groceries offering higher multipliers.

- Referrals: Some cards let you earn points by referring friends and family who are approved for the card.

RELATED ARTICLE: Maldives vs Bora Bora: Which Destination is Better?

The Do’s and Don’ts of Earning Points

- Pay Your Balance in Full – Avoid interest charges by paying off your card monthly.

- Choose Cards That Fit Your Goals – Pick cards aligned with your travel style, whether you prefer flights, hotels, or flexible rewards.

- Track Bonus Categories – Use your card strategically to earn extra points on dining, groceries, or travel.

- Take Advantage of Sign-Up Bonuses – Meet the minimum spend responsibly to unlock big rewards.

- Keep Your Credit Utilization Low – Use a low percentage of your credit limit to maintain a healthy credit score.

- Don’t Overspend to Earn Rewards – Rewards aren’t worth going into debt.

- Don’t Forget About Fees – Ensure the card’s perks outweigh its annual fee. Watch out for foreign transaction fees and interest fees.

- Don’t Miss Payment Deadlines – Late payments can hurt your credit score and lead to fees.

- Don’t Ignore Transfer Bonuses – Missed bonuses could mean less value for your points.

- Don’t Open Too Many Cards at Once – Multiple applications can lower your credit score temporarily.

RELATED ARTICLE: Top Things to Do in Mahe, Seychelles

RELATED ARTICLE: Must-Visit Beaches on La Digue, Seychelles

RELATED ARTICLE: How to Plan a Budget-Friendly Trip to the Seychelles

How to Redeem Credit Card Points for Travel

Redeeming points effectively depends on your travel goals.

For us, a major goal was celebrating my 30th birthday in Greece—a trip made possible largely through credit card points.

We flew Business Class with Turkish Airlines to Greece via Istanbul, and we were able to get an incredible flight redemption by transferring points from our Capital One Venture X card to one of its airline partners. This strategy not only saved us money but also elevated the entire travel experience.

Here’s how you can maximize your point redemptions and make your travel goals a reality:

Types of Points and Their Redemption for Travel

- Fixed Value Points: These have a set value when redeemed, often through your credit card’s travel portal.

- Transferable Points: These can be transferred to airline and hotel loyalty programs for potentially higher value. Examples include Chase Ultimate Rewards and AMEX Membership Rewards.

Strategies for Maximizing Your Points

- Travel Portals: Use your credit card’s portal to book travel with fixed value points.

- Award Availability: Plan in advance to secure award seats and room availability.

- Transfer Partners: Move points to partner programs like United Airlines or Hyatt for greater flexibility and higher redemption values.

- Transfer Bonuses: Take advantage of limited-time transfer bonuses to stretch your points further.

For an in-depth look at transfer partners and how to maximize their value, check out our Travelers’ Guide to Credit Card Transfer Partners.

RELATED ARTICLE: Honest Review of Waldorf Astoria Seychelles

RELATED ARTICLE: Complete Review of Waldorf Astoria Los Cabos Pedregal

How Many Cards Do You Need to Travel?

This depends on your travel goals and spending habits.

For some, one card with versatile rewards is enough.

Others may benefit from combining two or more cards to maximize benefits, such as pairing a general rewards card with an airline or hotel-specific card.

Learn more in our blog: “What’s the Best Travel Card to Start With?”

RELATED ARTICLE: Ultimate Layover Guide to Doha

FAQs About Travel Credit Card Points

Will opening credit cards hurt my credit score?

It may cause a slight, temporary dip, but responsible usage can improve your score over time.

Is it worth using points for travel?

Yes, points often provide better value for flights, hotels, or upgrades compared to cash-back rewards.

Should I use points or pay cash?

Use points when the redemption value exceeds what you’d pay in cash, typically for high-cost flights or luxury stays.

Are annual fees worth it?

If the perks, rewards, and travel credits outweigh the fee, then yes. Otherwise, consider a no-fee card.

Can I earn points on non-travel purchases?

Absolutely! Many cards offer bonus points for categories like dining, groceries, or online shopping.

Can I combine points from multiple cards?

Yes, some programs (e.g., Chase Ultimate Rewards) allow you to pool points from different cards from the same bank for greater flexibility. If multiple banks have the same transfer partner, then you can combine points from multiple banks to that same transfer partner, pooling all the points into one account.

Confused about transfer partners? Don’t worry, this guide will simplify it all and help you travel smarter.

RELATED ARTICLE: 10 Easy Money Saving Travel Tips

Conclusion

Travel credit card points can open the door to incredible travel experiences if used responsibly.

Whether you’re dreaming of sipping cocktails on a beach in Bali or flying first-class to a bucket-list destination like Tahiti, points can help you get there without straining your budget.

This article has given you the foundational knowledge to start earning, redeeming, and maximizing your points.

From choosing the right card to leveraging transfer partners, you’re now equipped to start turning everyday spending into extraordinary adventures.

But this is just the beginning.

For a deeper dive into transfer partners and maximizing your points, don’t miss our Travelers’ Guide to Credit Card Transfer Partners.

See the World, Save a Dollar, and make every point count!