Some of the best travel credit cards are more than just payment tools—they can be your ticket to smarter, more affordable vacations.

Disclosure: This post may contain affiliate links, which means we’ll receive a commission if you purchase through our links, at no extra cost to you. Please read full disclosure for more information.

Travel credit cards can transform how you plan, pay for, and experience your trips.

By earning points and miles on everyday purchases, you can save money on flights, hotels, and more, while unlocking valuable perks like free checked bags, lounge access, and travel protections.

These cards aren’t just about saving a dollar—they’re about making every dollar you spend work harder to help you travel more for less.

With over 50 countries explored, many of which we’ve reached using points and miles, we’ve gathered plenty of firsthand experience in making the most of travel credit cards.

This article covers seven standout travel credit cards, each offering unique benefits depending on your travel style and goals.

Whether you’re after flexibility, luxury, or no annual fee, there’s a card that can help you See the World, Save a Dollar.

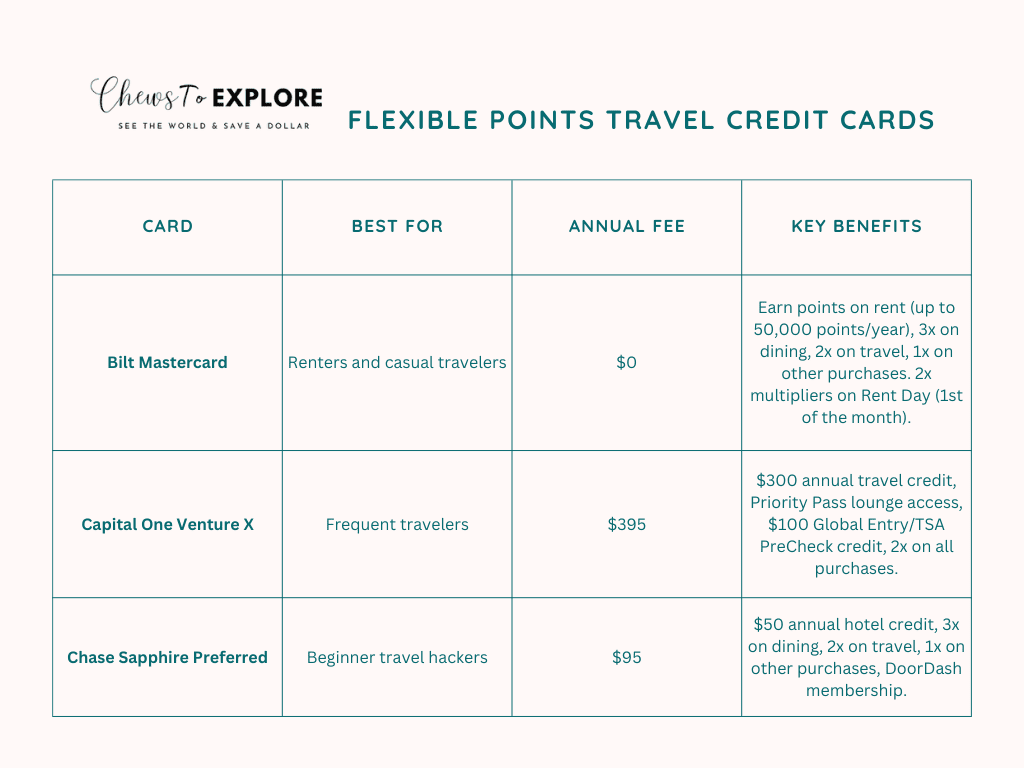

Keep reading to learn about some of our favorite flexible points travel credit cards:

- Bilt Mastercard

- Capital One Venture X

- Chase Sapphire Preferred

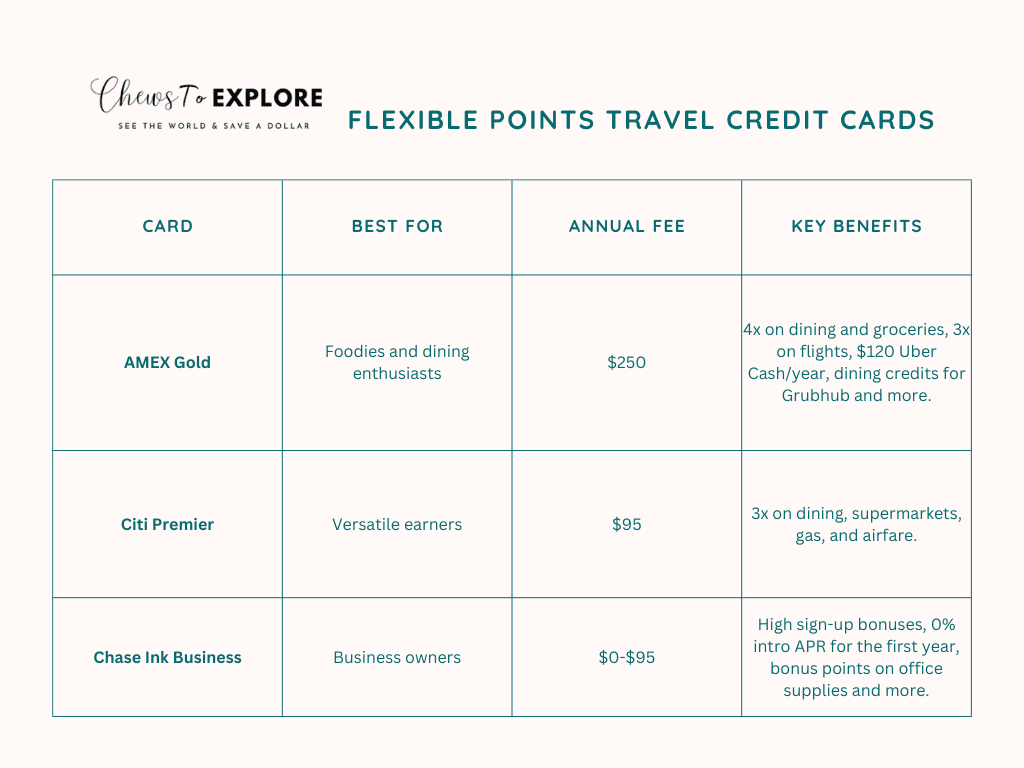

- AMEX Gold

- Citi Premier

- Chase Ink Business Cards

The key is finding a card that aligns with your travel habits and financial goals. We’ll also help guide you through the key features to consider when choosing a card.

While we’re here to help you navigate the choices, remember that everyone’s financial situation and travel preferences are different. We always recommend doing your own research to make sure the card you choose aligns with your needs and goals.

Now, let’s dive into what you should know about some of the best travel credit cards that can help you start earning rewards and travel smarter—no matter your style or budget.

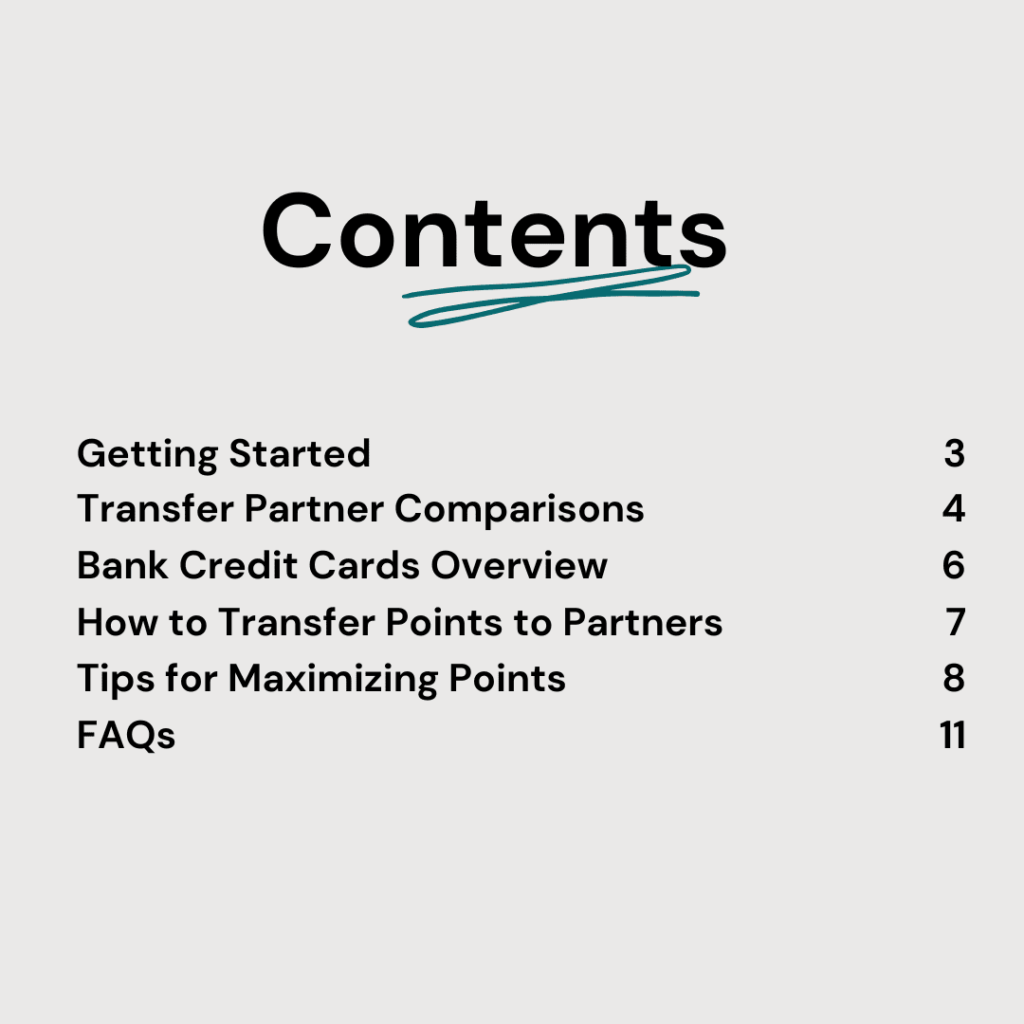

Want to stretch your travel points further? Grab the Travelers’ Guide to Credit Card Transfer Partners and save big on your next trip!

What to Look for in a Travel Credit Card

Before diving into the details of specific cards, it’s essential to understand what makes a travel credit card valuable.

The best card for you depends on your spending habits, travel plans, and personal preferences.

Here’s what to consider before applying:

Annual Fees: Are They Worth It?

Travel credit cards come with annual fees ranging from $0 to nearly $1,000. A higher fee doesn’t always mean a better card—it’s about whether the card’s benefits outweigh the cost.

For example, the AMEX Platinum Card has a $695 USD annual fee but offers perks like lounge access, hotel credits, and travel protections.

However, some of these benefits, like a $300 USD Equinox credit, may not be useful to everyone.

Be realistic about which perks you’ll actually use and whether they justify the annual fee.

RELATED ARTICLE: How to Travel with Credit Card Points

Sign-Up Bonuses: How They Can Jumpstart Your Travel Plans

Sign-up bonuses are one of the fastest ways to rack up points. Typically, you’ll need to spend a specific amount within a set timeframe to earn the bonus. Before applying, ask yourself if this spending requirement fits your budget.

Big expenses, like car insurance or home renovations, can be a great way to meet these requirements without overspending.

Also, consider the value of the bonus points. For instance, a Hilton card offering 180,000 points might sound generous, but if luxury Hilton properties cost 150,000 points per night, that’s just one free night.

On the other hand, a card offering 130,000 points plus a free night award might stretch further. Always evaluate the offer holistically.

RELATED ARTICLE: Review: Waldorf Astoria Seychelles Platte Island

RELATED ARTICLE: Hotel Review: Waldorf Astoria Los Cabos Pedregal

Earning Categories: Maximize Everyday Spending

Many travel credit cards offer bonus points for specific spending categories like dining, groceries, or travel.

Our rule of thumb is to aim for at least 2 points per dollar spent.

Some cards, like the Hilton Honors American Express, offer over 30 points per dollar spent at Hilton properties, which can add up quickly if you’re a loyal guest.

However, if you rarely stay at Hilton, those points won’t be as valuable. Choose a card with earning categories that match your regular expenses.

Interest Rates & Foreign Transaction Fees

The best way to use a credit card is to pay off the balance in full each month. Carrying a balance leads to interest charges, which can outweigh any travel rewards.

If you’re not ready to use credit responsibly, it’s better to explore other ways to save on travel.

Foreign transaction fees are another consideration, especially for international travelers.

Some cards, like the Chase Sapphire Preferred, waive these fees, while others, like some Chase Ink Business Cards, do not. Make sure your card aligns with your travel plans.

Currency of the Travel Credit Card

Travel cards can earn cash back, points, or miles. Some cards tie rewards to specific programs, like airlines or hotels, while others offer flexible points you can transfer to various partners.

Flexible currencies, like Chase Ultimate Rewards or American Express Membership Rewards, provide the most options and value.

For example, Chase has over 20 transfer partners, including airlines and hotels, allowing you to choose the best redemption for your needs. In contrast, a co-branded airline card limits you to that airline and its partners.

By understanding these key features, you’ll be better equipped to choose a travel credit card that helps you save money and make the most of your trips.

Top Flexible Points Travel Credit Cards

Let’s explore some of the top credit cards that are good for travel and how they can benefit you.

How to Decide Which Card Is Right for You

Match your spending habits and travel goals to the card benefits.

No two people have the same circumstances, and perks are only as good as the person’s situation.

While we can provide general information on why we think certain cards are great, it ultimately depends on your unique needs.

For more guidance, check out our article: What Is the Best Travel Credit Card to Start With?

Final Thoughts

The right travel credit card can open up more opportunities to explore the world while saving money. Take your time to evaluate the options and find one that fits your lifestyle.

If you’re looking to make the most of your travel credit card points check out the Travelers’ Guide to Credit Card Transfer Partners.

This simple guide breaks down how to transfer points, which partners offer the best value, and tips to save big on flights and hotels.

Whether you’re just starting with points or looking to level up your strategy, this guide has you covered.

Take the guesswork out of travel rewards and start saving today! Grab your guide now.

Great tips. Thank you!

We have been doing the no annual fee, but with 50,000 to 75,000 airline points with multiple credit cards. We do not pay for flights to overseas destinations. However, a person must spend an amount to qualify (e.g., 2,500 dollars in three or four months). FYI. Always like your posts. Travel safely.

Great tips! Definitely great to maximize all your points. A great way to do it is with the sign up bonuses. That’s a big way that we are able to accrue points